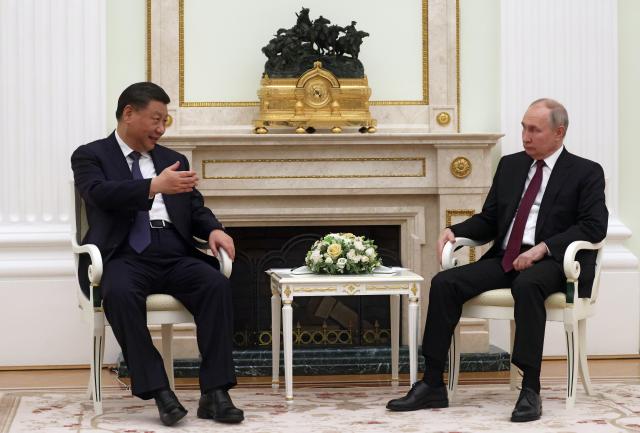

As Xi Jinping was saying goodbye to Vladimir Putin – after two days of meetings last month – he said that “Right now there are changes – the likes of which we haven’t seen for 100 years – and we are the ones driving these changes together.”

President Xi is not wrong about the gravity of the change we are living through.

We have seen the United States retreat from Afghanistan in the most embarrassing of manners.

We have seen the spending splurge of coronavirus lead to mountains of debt.

We have seen war return to Europe through Putin’s barbaric invasion of Ukraine.

We have seen commitments to embrace net zero emissions make western countries dependent on others for energy.

We have seen China help sign a historic agreement between Saudi Arabia and Iran.

We have seen India become closer to Russia through record purchases of oil and gas from them.

But the most concerning change though is the one that has gone almost unreported. This year some countries have announced that they will settle trades in Chinese Yuan not US dollars.

China’s aim is to remove the US dollar as the globe’s reserve currency. It is not yet clear whether they will succeed but they are giving it a red hot shot.

The current global financial architecture is much younger than most would realise. Until 1971, just 50 years ago, the value of the US dollar was pegged to gold at US$35 per ounce.

The pressures of government spending, the Vietnam War and inflation forced President Nixon to end the gold standard. The value of gold is now around US$2000 per ounce. In gold terms, the value of the US dollar has lost 98 per cent of its value in a generation. It took the Romans two hundred years to devalue their currency by the same amount.

Notwithstanding the devaluation, the US dollar still remains in high demand partly because it is the currency of choice for world trade. Following the upheaval of the 1970s, the US and Saudi Arabia finalised the “petrodollar agreement”. They agreed to price and trade oil in US dollars. This increased demand for US dollars, helped keep US interest rates low and in one sense we moved from a “gold standard” to a “petrol standard”.

Just like the 1970s we once again have war, government debt, energy shortages and inflation. China is trying to use this instability to destroy the petrodollar system. The question is how much China has helped create these unstable conditions.

China has helped Russia pursue a war in Ukraine – one of the world’s most important resources of food and energy.

China helped spread Covid-19, at least through their lack of transparency about its initial spread and possibly through a leak from one of its own labs.

And China has helped create an artificial energy crisis by paying lip service to climate change commitments. The gullible nations of the west have restricted their energy supplies while China builds two coal fired power stations every week.

Net zero emissions has created an effect similar to that of the 1970s oil embargo, except this time we have agreed to embargo ourselves.

Unless we wake up to things soon, Xi may get his wish of the kind of change that only happens every 100 years. Australia will not benefit from any move that makes China a more dominant global player. Our best response is to get back to developing our own energy and resources so we are not reliant on China and take control of our own destiny again.